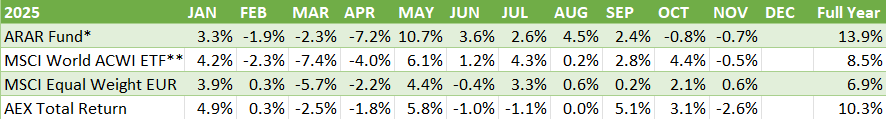

We have a trackrecord that speaks volumes

- Personal portfolio: +70% in 2022-2023 vs <-15% S&P 500 (Jan 2023)

- Asset Management for a Quote 500 member: +18.4%, IRR +98% p.a. on advice activity (Sep 2021 through March 2022)

- The Fund has outperformed near-peer benchmarks since inception and is up +29% since inception two-and-a-half years ago (March 2023 through August 2025)

(First two returns are results of the fund manager in various mandates. They have been obtained outside of the Van der Mandele ARAR Fund and are for illustrative purposes only. Historical results are no guarantee for future performance.)